Welcome and thanks for reading!

In this review, I will make a summary of important and interesting news and events over the last week related to my portfolio holdings. Also, I will put together some interesting articles from other websites that caught my attention during the past week.

Received Dividends:

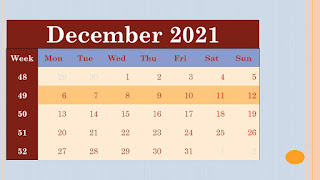

December 6, 2021

- € 28.38 – Magna International Inc. (MGA)

December 7, 2021

- € 42.05 – Johnson & Johnson (JNJ)

December 8, 2021

- € 23.47 – United Parcel Service, Inc. (UPS)

- € 2.47 – Visa Inc. (V)

- € 20.66 – Archer-Daniels-Midland Company (ADM)

Dividend income is reported after the deduction of taxes. Check more at my Monthly Dividend sheet.

Portfolio Holdings News:

December 6, 2021

- Intel Corporation (INTC) Announces Intent to Take Mobileye Public; INTC announced its intention to take Mobileye public in the United States in mid-2022 via an initial public offering (IPO) of newly issued Mobileye stock. The move will unlock the value of Mobileye for Intel shareholders by creating a separate publicly traded company and will build on Mobileye’s successful track record and serve its expanded market.

- Kinder Morgan, Inc. (KMI) Announces 2022 Financial Expectations; KMI says it expects an annualized $1.11/share dividend and $750M available for stock buybacks, while generating $7.2B of adjusted EBITDA, up 5% from the 2021 forecast excluding effects related to Winter Storm Uri.

- TELUS Corporation (TSX: T) announces sale of its financial solutions business; T announced the sale of its financial solutions business to Dye & Durham for $500 million, a leading provider of cloud-based software and technology solutions designed to improve efficiency and increase productivity for the legal community, business professionals, governments and financial institutions. The transaction closing date is today, December 6, 2021.

December 7, 2021

- Raytheon Technologies Corporation (RTX) Authorizes $6 Billion Share Repurchase Program; RTX’s Board of Directors authorized today the repurchase of up to $6 billion of the company's outstanding common stock. The new authorization replaces the company's previous program, approved Dec. 7, 2020. Share repurchases may take place from time to time, subject to market conditions and at the company's discretion, in the open market, through privately negotiated transactions or other means.

- Main Street Capital Corporation (MAIN) Announces New Portfolio Investment; MAIN announce that it recently completed a new portfolio investment to facilitate the recapitalization of Valley Veterinary Clinic, LLC d/b/a Valley Vet Supply ("Valley Vet Supply" or the "Company"), a leading omnichannel retailer of animal health products and supplies. Main Street, along with several co-investors, partnered with the Company's existing owners and management team to facilitate the transaction, with Main Street funding $42.2 million in a combination of first lien, senior secured term debt and a direct equity investment.

- Enbridge Inc. (ENB) Announces Three Percent Quarterly Dividend Increase for 2022; ENB announced today that its Board of Directors has declared a quarterly dividend of $0.860 per common share, payable on March 1, 2022 to shareholders of record on February 15, 2022. The declared dividend represents a three percent increase from the prior quarterly rate and the twenty-seventh consecutive year in which the Company has increased its common share dividend.

December 8, 2021

- Kesko Corporation (KESKO) to acquire Kungälvs Trävaruaktiebolag; KESKO will acquire Kungälvs Trävaruaktiebolag, thus strengthening its position in the Swedish building and home improvement trade market in the Gothenburg area.

- NCC AB (NCC) signs contract for hospital project in Oulu, Finland; NCC has been commissioned to continue construction of Oulu University Hospital in Finland with the assignment to construct building F. This is part of the second phase of the hospital’s development program and the order value is approximately SEK 1.3 billion.

- ConocoPhillips (COP) Announces Agreement to Sell Indonesia Assets and Exercising its Preemption Right to Purchase Up to an Additional 10% Shareholding Interest in APLNG; COP announced it has entered into an agreement to sell the subsidiary that indirectly owns the company’s 54% interest in the Indonesia Corridor Block Production Sharing Contract (PSC) and a 35% shareholding interest in the Transasia Pipeline Company. The sale to MedcoEnergi for $1.355 billion is subject to customary adjustments and is expected to close in early 2022, subject to certain conditions precedent. In addition, through its Australian subsidiary, the company announced that it has notified Origin Energy that it is exercising its preemption right to purchase up to an additional 10% shareholding interest in Australia Pacific LNG (APLNG) from Origin Energy for up to $1.645 billion, which will be funded from cash on the balance sheet, subject to customary adjustments.

- W. P. Carey Inc. (WPC) Increases Quarterly Dividend; WPC reported that its Board of Directors increased its quarterly cash dividend to $1.055 per share, equivalent to an annualized dividend rate of $4.22 per share. The dividend is payable on January 14, 2022 to stockholders of record as of December 31, 2021.

December 10, 2021

- Pfizer Inc. (PFE) Increases Quarterly Dividend; PFE announced that its board of directors declared an increase in the quarterly cash dividend on the company’s common stock to $0.40 for the first-quarter 2022 dividend, payable March 4, 2022, to holders of the Common Stock of record at the close of business on January 28, 2022. The first-quarter 2022 cash dividend will be the 333rd consecutive quarterly dividend paid by Pfizer.

- CVS Health Corporation (CVS) Increases Quarterly Dividend; CVS announced that its board of directors has approved a quarterly dividend of fifty-five cents ($0.55) per share on the Common Stock of the Corporation. The dividend is payable on February 1, 2022, to holders of record on January 21, 2022.

- Lockheed Martin Corporation (LMT): Finland Selects F-35 Lightning II As Its Next Fighter; The Finnish Government has announced Lockheed Martin (LMT)'s 5th Generation F-35 Lightning II is the aircraft selected from its HX Fighter Program. By selecting the F-35, Finland gains a significant capability to ensure stability in the region.

- Union Pacific Corporation (UNP) Announces Dividend Increase; UNP announced that its Board of Directors today voted to increase the quarterly dividend on the Company’s common shares by 10% to $1.18 per share. The dividend is payable December 30, 2021, to shareholders of record December 20, 2021. Union Pacific has paid dividends on its common stock for 122 consecutive years.

- T. Rowe Price Group, Inc. (TROW) Reports Preliminary Month-End Assets Under Management for November 2021; TROW reported prelim AUM of $1.63T as of Nov.30 compared to $1.67T as of prior month end.

- Lazard Ltd (LAZ) Reports November 2021 Assets Under Management; LAZ reported that its preliminary assets under management (“AUM”) as of November 30, 2021 totaled approximately $267.4 billion. The month’s AUM included market depreciation of $5.8 billion, foreign exchange depreciation of $3.4 billion and net outflows of $3.1 billion.

Articles that caught my attention:

- Undervalued Dividend Growth Stock of the Week: Amgen (AMGN) by Jason Fieber, Mr. Free at 33, at Daily Trade Alert

- How Many Dividend Stocks Should I Own? by Tom at Dividends Diversify

- 7 Dividend Growth Stocks For December 2021 by FerdiS at TheStreet.com

- Keg Royalties Income Fund by SPBrunner at Investment Talk

- AT&T: Capitulation Time by Jonathan Weber at Seeking Alpha

- Buy The Dip: 3 REITs Getting Way Too Cheap by Jussi Askola at Seeking Alpha

- Top 5 Dividend Growth Stocks to Buy in December 2021 by Jason Fieber, Mr. Free at 33, at Daily Trade Alert

- STORE Capital Stock: High-Quality REIT by Dividend Power

- Financial planners shouldn’t be worried about FIRE by Mark at My Own Advisor

- Canadian Banks Q4 Review [Podcast] by DivGuy at The Dividend Guy Blog

- Favourite Stocks — 5 Stocks I Cherish by Graham at Reverse the Crush

- Safest 7% Yield, Government Guaranteed, To Park Your Cash by Rida Morwa at Seeking Alpha

- Triple Your Retirement Income With These 6% Yielding Dividend Aristocrat Bargains by Dividend Sensei at Seeking Alpha

- CVS Health Drops The Dividend Bombshell by Jonathan Weber at Seeking Alpha

- Dividend Kings In Focus: Target Corporation by Bob Ciura at Sure Dividend

- Our Perfect Dividend Record Through The Pandemic by Dale Roberts at Seeking Alpha

Thanks for stopping by, have a nice next week!

No comments:

Post a Comment