Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week related

to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

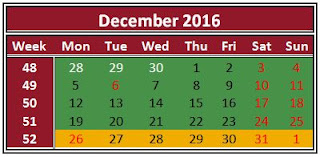

Saturday, December 31, 2016

Friday, December 30, 2016

Recent Buy - Cisco Systems, Inc. (CSCO)

Today I made my last purchase for this year, I Bought 35 shares of Cisco Systems,

Inc. at $ 30.28 per share plus commission.

My overall cost basis of this position increases from $ 27.33 to $ 28.05 per share. I totally hold now 150 shares of CSCO and my yield on cost is 3.71%. You can look at my first purchase of CSCO here.

My overall cost basis of this position increases from $ 27.33 to $ 28.05 per share. I totally hold now 150 shares of CSCO and my yield on cost is 3.71%. You can look at my first purchase of CSCO here.

Monday, December 26, 2016

Week in Review 51/16

Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week

related to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Sunday, December 25, 2016

Recent Buy - Algonquin Power & Utilities Corp (AQN.TO)

On Friday, December 23, I bought 100 shares of Algonquin Power & Utilities Corp. at CA$ 11.43 per share plus commission.

My overall cost basis of this position decreases from CA$ 11.80 to CA$ 11.72 per share. I totally hold now 400 shares of AQN and my yield on cost is 4.90%. I purchased my first AQN's shares a couple of months ago, you can read my first acquisition of AQN here.

My overall cost basis of this position decreases from CA$ 11.80 to CA$ 11.72 per share. I totally hold now 400 shares of AQN and my yield on cost is 4.90%. I purchased my first AQN's shares a couple of months ago, you can read my first acquisition of AQN here.

Friday, December 23, 2016

Recent Buy - W. P. Carey Inc. (WPC)

Yesterday on 22nd December I Bought 17 shares of W. P.

Carey Inc. at $ 58.52 per share plus commission.

My overall cost basis of this position decreases from $

61.56 to $ 60.57 per share. I totally hold now 47 shares of WPC and my yield on

cost is 6.54%. I purchased my first WPC's shares about one and half year ago,

you can read my first acquisition of WPC here.

Thursday, December 22, 2016

Recent Buy - General Electric Company (GE)

Yesterday on 21st December I Bought 30 shares of General Electric Company at $ 32.08 per share plus commission.

My overall cost basis of this position increases from $ 25.58 to $ 26.53 per share. I totally hold now 210 shares of GE and my yield on cost is 3.62%. I purchased my first GE's shares over two years ago, you can read my first acquisition here.

My overall cost basis of this position increases from $ 25.58 to $ 26.53 per share. I totally hold now 210 shares of GE and my yield on cost is 3.62%. I purchased my first GE's shares over two years ago, you can read my first acquisition here.

Sunday, December 18, 2016

Week in Review 50/16

Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week

related to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Tuesday, December 13, 2016

Dividend Increase – Pfizer Inc. (PFE)

Yesterday the board of directors of Pfizer Inc. announced a quarterly dividend increase of from $ 0.30 to $ 0.32 per share that’s payable March 1, 2017 to holders of record February 3, 2017. This represents a 6.67% increase to regular quarterly dividends.

With current price $ 32.40 (yesterday's close), this raise

brings their dividend yield to 3.95%.

Since I own 200 shares this will increase my yearly net

dividends by $ 11.92.

Sunday, December 11, 2016

Week in Review 49/16

Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week

related to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Saturday, December 10, 2016

Dividend Increase – General Electric Co. (GE)

Yesterday on December 9 General Electric Co. announced a quarterly dividend increase of from $ 0.23 to $ 0.24 per share that’s payable January 25, 2017 to holders of record December 27, 2016. This represents a 4.35% increase to regular quarterly dividends. With current price $ 31.78 (yesterday's close), this raise brings their dividend yield to 3.02%.

Since I own 180 shares, this will increase my yearly net

dividends by $ 5.36.

That increase rises my YOC to 3.75%

Click here

to see my portfolio holdings.

Thanks for stopping by!

Thursday, December 8, 2016

Dividend Income - November 2016

Again, one month passed and it is time to report my

dividend income. In November 2016 my portfolio dividend income was as follows:

Annual dividend received from:

NCC AB B (NCC-B) - € 89.69 ($ 99.54)

Oriflame Hld (ORI) - € 59.85 ($ 63.84)

Quarterly dividends received from:

Annual dividend received from:

NCC AB B (NCC-B) - € 89.69 ($ 99.54)

Oriflame Hld (ORI) - € 59.85 ($ 63.84)

Quarterly dividends received from:

AT&T Inc. (T) - €135.53 ($ 148.80)

AbbVie Inc. (ABBV) - € 15.95 ($ 17.10)

AbbVie Inc. (ABBV) - € 15.95 ($ 17.10)

Kinder Morgan Inc. (KMI) - € 23.37 ($ 25.01)

ONEOK Inc. (OKE) - € 28.64 ($ 30.75)

ONEOK Inc. (OKE) - € 28.64 ($ 30.75)

Omega Healthcare Investors (OHI) - € 85.34 ($ 91.50)

Emera Incorporated (EMA.TO) - € 29.08 ($ 31.13)

Eaton Corporation (ETN) - € 16.15 ($ 17.10)

Emera Incorporated (EMA.TO) - € 29.08 ($ 31.13)

Eaton Corporation (ETN) - € 16.15 ($ 17.10)

HCP Inc. (HCP) - € 34.91 ($ 37.00)

Royal Bank of Canada (RY.TO) - € 69.43 ($ 73.82)

Alerian MLP ETF (AMLP) - € 113.28 ($ 120.00)Tuesday, December 6, 2016

Recent Buy - Gilead Sciences Inc. (GILD)

Yesterday on 5th December I Bought 15 shares of Gilead Sciences Inc. at $ 71.95 per share plus commission.

My overall cost basis of this position decreases from $ 80.14 to $ 76.77 per share. I totally hold now 35 shares of GILD and my yield on cost is 2.45%. You can look at my first purchase of GILD here.

My overall cost basis of this position decreases from $ 80.14 to $ 76.77 per share. I totally hold now 35 shares of GILD and my yield on cost is 2.45%. You can look at my first purchase of GILD here.

Sunday, December 4, 2016

Week in Review 48/16

Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week

related to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Thursday, December 1, 2016

Recent Buy - Flowers Foods, Inc. (FLO)

29th November I added 60 shares of Flowers Foods Inc. (FLO) at $ 15.69 per share plus commission ($ 5.00). My overall cost basis of this position increases from $ 15.09 to $ 15.31 per share. I totally hold now 185 shares of FLO and my yield on cost is 4.18%. You can look at my first purchase of FLO here.

Sunday, November 27, 2016

Week in Review 47/16

Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week

related to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Sunday, November 20, 2016

Week in Review 46/16

Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week

related to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Sunday, November 13, 2016

Week in Review 45/16

Welcome and thanks for reading! In this review, I will gather

together important and interesting news and events over the last week related

to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Thursday, November 10, 2016

Recent Buy - V.F. Corporation (VFC)

Yesterday on November 9, I Bought 25 shares of V.F. Corporation at $ 52.98 per share.

V.F. Corporation engages in the design, production,

procurement, marketing, and distribution of branded lifestyle apparel,

footwear, and related products in the United States and Europe. The company

primarily offers outdoor apparel, footwear and equipment, youth culture/action

sports-inspired footwear, handbags, luggage, backpacks, totes, accessories,

surfing-inspired footwear, merino wool socks, women’s activewear, and travel

accessories under the The North Face, Vans, Timberland, Kipling, Napapijri,

Jansport, Reef, Smartwool, Eastpak, lucy, and Eagle Creek brands. It also

provides denim, casual apparel, footwear, and accessories under the Wrangler,

Lee, Lee Casuals, Riders by Lee, Rustler, Timber Creek by Wrangler, and Rock

& Republic brands. In addition, the company offers occupational, protective

occupational, athletic, licensed athletic, and licensed apparel products under

the Red Kap, Bulwark, Horace Small, Majestic, MLB, NFL, and Harley-Davidson

brands; sportswear apparel, luggage, and accessories under the Nautica brand;

and handbags, luggage, backpacks, totes, and accessories under the Kipling

brand. Further, it provides premium denim apparel, footwear, and accessories

under the 7 For All Mankind, Splendid, and Ella Moss brands. The company sells

its products primarily to specialty stores, department stores, national chains,

and mass merchants, as well as sells through company operated stores,

concession retail stores, and e-commerce sites. V.F. Corporation was founded in

1899 and is headquartered in Greensboro, North Carolina

Tuesday, November 8, 2016

Recent Buy - Cardinal Health, Inc. (CAH)

Yesterday on November 7, I Bought 20 shares of Cardinal Health, Inc. at $ 65.69 per share.

Cardinal Health, Inc. operates as a healthcare services

and products company worldwide. The company’s Pharmaceutical segment

distributes branded and generic pharmaceutical, over-the-counter healthcare,

specialty pharmaceutical, and consumer products to retailers, hospitals, and

other healthcare providers. It offers distribution, inventory management, data

reporting, new product launch support, and contract pricing and chargeback

administration services to pharmaceutical manufacturers; pharmacy and

medication therapy management, and patient outcomes services to hospitals,

other healthcare providers, and payers; consulting, patient support, and other

services to pharmaceutical manufacturers and healthcare providers. This segment

also operates nuclear pharmacies and cyclotron facilities that manufacture,

prepare, and deliver radiopharmaceuticals, as well as operates

direct-to-patient specialty pharmacies; offers logistics, marketing, and other

services; and repackages generic pharmaceuticals and over-the-counter

healthcare products. The company’s Medical segment distributes a range of

medical, surgical, and laboratory products and services to hospitals,

ambulatory surgery centers, clinical laboratories, and other healthcare

providers, as well as to patients in the home. This segment also develops,

manufactures, and sources medical and surgical products comprising surgical

drapes, and gowns and apparel; exam and surgical gloves; fluid suction and

collection systems; cardiovascular and endovascular products; and wound care

and orthopedic products, as well as assembles and offers sterile and

non-sterile procedure kits. In addition, it offers supply chain services,

including spend, distribution, and inventory management services to healthcare

providers; and post-acute care management, and transition services and software

to hospitals, other healthcare providers, and payers. The company was founded

in 1979 and is headquartered in Dublin, Ohio.

Monday, November 7, 2016

Dividend Income - October 2016

Again, one month passed and it is time to report my

dividend income. In October 2016 my portfolio dividend income was as follows:

TD Bank Group (TD.TO) - € 67.23 ($ 73.76)

Semiannual dividend received from:

Telia Company (TELIA1) - €307.80 ($337.69)

Quarterly dividends received from:

Telia Company (TELIA1) - €307.80 ($337.69)

Quarterly dividends received from:

Baxter International Inc. (BAX) - € 6.96 ($ 7.80)

TELUS Corporation (TU) - € 46.86 ($ 52.54)

Golar LNG (GLNG) - € 6.68 ($ 7.50)

PepsiCo Inc. (PEP) - € 67.12 ($ 75.25)

The Coca-Cola Company (KO) - € 46.88 ($ 52.50)

The Coca-Cola Company (KO) - € 46.88 ($ 52.50)

Altria Group Inc. (MO) - € 95.71 ($ 106.75)

Philip Morris International Inc. (PM) - € 80.54 ($ 88.40)

The Kraft Heinz Co. (KHC) - € 53.57 ($ 60.00)

W. P. Carey Inc. (WPC) - € 26.93 ($ 29.55)

Algonquin Power & Utilities Corp. (AQN.TO) - € 28.61 ($ 31.77)

Algonquin Power & Utilities Corp. (AQN.TO) - € 28.61 ($ 31.77)

VEREIT Inc. (VER) - € 40.69 ($ 44.69)

Agrium Inc. (AGU) - € 20.09 ($ 21.88)

General Electric Co. (GE) - € 38.02 ($ 41.40)

Scotiabank (BNS.TO) - € 77.96 ($ 85.62)

Cisco Systems Inc. (CSCO) - € 27,41 ($ 29.90) TD Bank Group (TD.TO) - € 67.23 ($ 73.76)

Sunday, November 6, 2016

Week in Review 44/16

Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week

related to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Saturday, November 5, 2016

Dividend Increase – TELUS Corporation (TSX: T, NYSE: TU)

Yesterday the Board of Directors of TELUS Corporation announced a quarterly dividend increase of from CA$ 0.46 to CA$ 0.48 per share that’s payable January 3, 2017 to holders of record December 9, 2016. This represents a 9.09% increase year-over-year and 4.35% increase to the last quarter dividend. This was a twelfth dividend increase since TELUS announcing their multi-year dividend growth program in May 2011 With current price CA$ 42.40 (Yesterday's close), this raise brings their dividend yield to 4.53%.

Since I own 150 shares, this will increase my portfolio's

projected annual net dividend income by CA$ 8.94.

That increase rises my YOC to 4.31%.

Click here

to see my portfolio holdings.

You can follow the development of my dividends here.

Thanks for stopping by!

Friday, November 4, 2016

Dividend Increase – Inter Pipeline Ltd. (TSE:IPL)

3th November Inter Pipeline Ltd. announced that its board of directors has approved a 3.8 percent increase to its monthly cash dividend from CA$ 0.13 to CA$ 0.135 per share. On an annualized basis, dividends will increase by CA$ 0.06 per share from CA$ 1.56 to CA$ 1.62. Shareholders of record as of November 22, 2016 will be eligible for Inter Pipeline's new monthly dividend rate of CA$ 0.135 per share, with payment expected on or about December 15, 2016.

Since I own 200 shares this will increase my yearly net

dividends by CA$ 8.94.

That increase rises my YOC to 6.20%

Click here

to see my portfolio holdings.

Tuesday, November 1, 2016

Income and Expenses, Savings Rate for Q3 2016

Time has passed very quickly, it is already November and the time to look, how I managed during the third quarter, and how my journey towards financial independence is progressing. The past year has so far gone reasonably well, although I'll not achieve my dividend income goals, I'm still fairly satisfied with my achievements. Since this is the second year when I keep a stricter control of my spending, I also made a comparison with last year's results. As I mentioned in my first income / expenditure report, I will make a summary on a quarterly basis, because my months in the case of income are very different. This will give me a better view of the overall situation and hopefully will inspire some of my blog readers.

Sunday, October 30, 2016

Week in Review 43/16

Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week

related to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Friday, October 28, 2016

Dividend Increase – AbbVie Inc. (ABBV)

Today, October 28 AbbVie Inc. announced a quarterly dividend increase of from $ 0.57 to $ 0.64 per share that’s payable February 15, 2017 to holders of record January 13, 2017. This represents a 12.3% increase to regular quarterly dividends. With current price $ 61.46 (yesterday's close), this raise brings their dividend yield to 4.17%.

Since I own 30 shares this will increase my yearly net

dividends by $ 6.26.

That increase rises my YOC to 4.05%

Click here

to see my portfolio holdings.

Thanks for stopping by!

Wednesday, October 26, 2016

Recent Buy - Emera Incorporated (EMA.TO)

On Tuesday, October 25, I Bought 80 shares of Emera Incorporated at CA$ 47.25 per share plus commission.

Emera Incorporated, an energy and services company,

through its subsidiaries, engages in the generation, transmission, and

distribution of electricity to various customers. The company is also involved

in gas transmission and utility energy services businesses; and the provision

of energy marketing, trading, and other energy-related management services. In

addition, it transports re-gasified liquefied natural gas to consumers in the

northeastern United States through its 145-kilometre pipeline in New Brunswick.

The company serves approximately 506,000 customers in Nova Scotia; 158,000

customers in the state of Maine; and 126,000 customers in the island of

Barbados. Emera Incorporated was founded in 1919 and is headquartered in

Halifax, Canada.

Monday, October 24, 2016

Dividend Increase – AT&T Inc. (T)

On Saturday, October 22 AT&T Inc. announced a quarterly dividend increase of from $ 0.48 to $ 0.49 per share that’s payable February 1, 2017 to holders of record January 10, 2017. This represents a 2.08% increase to regular quarterly dividends. With current price $ 37.49 (Friday's close), this raise brings their dividend yield to 5.23%.

Since I own 310 shares this will increase my yearly net

dividends by $9.24.

That increase rises my YOC to 5.53%

Click here

to see my portfolio holdings.

Subscribe to:

Posts (Atom)