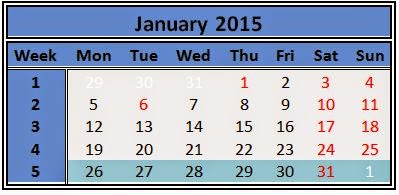

Yesterday the Board of Directors of Digital Realty Trust Inc. announced a quarterly dividend increase of from $0.83 to $0.85 per share that’s payable March 31, 2015 to holders of record March 13, 2015. This represents a 2.4% increase to regular quarterly dividends. With current price $65.60 (today's open), this raise brings their dividend yield to 5.18%.

Since I own 120 shares, this will increase my portfolio's projected annual net dividend income by $7.15.

That increase rises my YOC to 7.12%.

Click here

to see my portfolio holdings.

You can follow the development of my dividends here.