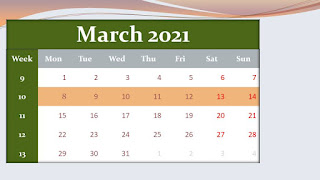

Monday, March 29th, I bought 10 shares of Air Products and Chemicals, Inc. (APD) at $ 284.82 per share plus commission.

Air Products touches the lives of consumers around the globe in positive ways every day. Focused on serving energy, environment and emerging markets, we provide essential industrial gases, related equipment and applications expertise to customers in dozens of industries, including refining, chemical, metals, electronics, manufacturing, and food and beverage. We are also the global leader in the supply of liquefied natural gas process technology and equipment. Air Products develops, engineers, builds, owns and operates some of the world's largest industrial gas projects, including gasification projects that sustainably convert abundant natural resources into syngas for the production of high-value power, fuels and chemicals.

Looking into the future, Air Products sees significant opportunities in gasification, carbon capture and hydrogen for energy to help solve the world’s urgent sustainability challenges. Gasification enables an environmentally friendly way to use plentiful, lower value feedstocks. We see significant opportunities to capture the concentrated CO2 stream from gasifiers and hydrogen plants. Air Products is a leader in hydrogen fueling systems and infrastructure, and the company sees great potential in the years ahead to extend its leadership.

Air Products and Chemicals, Inc. was founded in 1940 and is headquartered in Allentown, Pennsylvania.