Welcome and thanks for reading!

In this review, I will make a summary of important and interesting news and events over the last week related to my portfolio holdings. Also, I will put together some interesting articles from other websites that caught my attention during the past week.

Received Dividends:

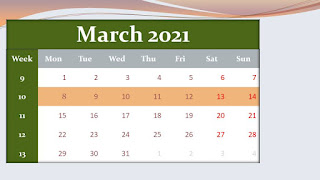

March 8, 2021

- € 59.90 – Pfizer Inc.

- € 11.06 – Starbucks Corporation

March 9, 2021

- € 37.93 – Johnson & Johnson

March 10, 2021

- € 48.64 – Target Corporation

- € 48.11 – Chevron Corporation

- € 18.92 – Emerson Electric Co.

- € 41.29 – United Parcel Service Inc.

March 11, 2021

- € 61.23 – Prudential Financial Inc.

- € 28.03 – Global X SuperDividend ETF

March 12, 2021

- € 18.51 – 3M Company

Dividend income is reported after the deduction of taxes. Check more at my Monthly Dividend sheet.

Portfolio Holdings News:

March 8, 2021

March 9, 2021

- NCC AB (NCC) has completed the sale of Valle View in Oslo; NCC has completed the sale of Valle View, the last remaining part of the property development project in the Helsfyr area in Oslo that was sold in August 2019. There will be a positive impact on cashflow in the first quarter 2021 but earnings in the quarter will be impacted by provisions for rental guarantees and VAT.

- NCC AB (NCC) to build seven apartment buildings for the City of Helsinki; NCC has been commissioned by the City of Helsinki to build seven apartment buildings with in total 187 apartments in the Herttoniemi area in eastern Helsinki. The combined order value is approximately 35 MEUR.

March 10, 2021

- Qualcomm Incorporated (QCOM) Increases Quarterly Dividend by 5 Percent; QCOM announced that its Board of Directors has approved a 5 percent increase in the Company's quarterly cash dividend. The quarterly cash dividend will increase from $0.65 to $0.68 per share of common stock and will be effective for quarterly dividends payable after March 25, 2021.

- ConocoPhillips (COP) 2021 Share Repurchase Program of $1.5 Billion Underway; COP announced that it resumed its share repurchase program at an annualized level of $1.5 billion, a 50% increase compared to the level of repurchases underway in the fourth quarter of 2020 when the program was suspended due to the Concho transaction. The company expects to execute the program ratably across all four quarters in 2021.

- T. Rowe Price Group (TROW) Reports Preliminary Month-End Assets Under Management for February 2021; TROW reports preliminary month-end assets under management of $1.50 trillion as of February 28, 2021. Client transfers from mutual funds to other portfolios, including trusts and separate accounts, were $1.1 billion in February 2021 and $3.9 billion for the quarter-to-date period ended February 28, 2021.

- Lazard Ltd (LAZ) Reports February 2021 Assets Under Management; LAZ reports that its preliminary assets under management (“AUM”) as of February 28, 2021 totaled approximately $260.7 billion. The month’s AUM included market appreciation of $5.6 billion, net inflows of $0.2 billion and foreign exchange depreciation of $0.3 billion.

March 11, 2021

- W. P. Carey Inc. (WPC) Increases Quarterly Dividend; WPC announces that its Board of Directors increased its quarterly cash dividend to $1.048 per share, equivalent to an annualized dividend rate of $4.19 per share. The dividend is payable on April 15, 2021 to stockholders of record as of March 31, 2021.

March 12, 2021

- Fortum Corporation (FORTUM) Reports 2020 Fourth Quarter and Full Year Financial Results; FORTUM reports EPS of € 0.43, a 147% increase from the prior. Revenue was € 21.28 billion, which was € 7.2 billion lower than expected. Fortum's Board of Directors proposes a dividend of EUR 1.12 (1.10) per share.

- Fortum Corporation (FORTUM) to sell its district heating business in the Baltics for EUR 800 million; FORTUM has signed an agreement to sell its district heating business in the Baltics to Partners Group. Fortum expects to record a tax exempt capital gain of approximately EUR 240 million in the City Solutions segment’s second-quarter 2021 results. The transaction is subject to customary closing conditions and is expected to be completed in the second quarter of 2021.

- Kesko Corporation’s (KESKO) comparable sales grew in February; KESKO’s sales totalled €797.9 million in February 2021, representing an increase of 3.0% in comparable terms on the previous year.

- Kinder Morgan, Inc. (KMI) Announces Formation of New Energy Transition Ventures Group; KMI announces that it formed a new Energy Transition Ventures group to identify, analyze and pursue commercial opportunities emerging from the low-carbon energy transition.

- Cardinal Health (CAH) signs definitive agreement to sell its Cordis business to Hellman & Friedman; CAH announces that it has signed a definitive agreement to sell its Cordis business to Hellman & Friedman (H&F) for approximately $1 billion, which includes buyer's assumption of certain liabilities and seller's retention of certain working capital accounts. The transaction is expected to close in the first half of Cardinal Health's fiscal year 2022.

Articles that caught my attention:

- Undervalued Dividend Growth Stock of the Week: Home Depot (HD) by Jason Fieber, Mr. Free at 33, at Daily Trade Alert

- Wolters Kluwer Dividend Safety – Analysis [2021] by European Dividend Growth Investor

- Emera Inc. by SPBrunner at Investment Talk

- Brookfield Renewables: Dodging The Bursting Bubble by Trapping Value at Seeking Alpha

- Empower Your Rich Retirement With 7.8% Yielding Enterprise Products Partners by Dividend Sensei at Seeking Alpha

- My Expectations For Kinder Morgan And Its 6.5% Yield by Julian Lin at Seeking Alpha

- 7 of the Top Transportation Stocks to Buy Right Now by Louis Navellier and the InvestorPlace Research Staff at Daily Trade Alert

- Genuine Products Company – A Slightly Overvalued Dividend King by Dividend Power

- Investing For FIRE? Dividend Growth Is The Way To Go by Cashflow Capitalist at Seeking Alpha

- Canadian Pacific Railway: A New Dividend Aristocrat by Derek at Engineer my Freedom

- The 3 Best Canadian Dividend Stocks For 2021 by Harvi Sadhra at Sure Dividend

- Income vs. Growth Investing: Which Is Right For You? By Tom at Dividends Diversify

- Dividend Aristocrats: 5 To Buy And 5 You Should Avoid by Jonathan Weber at Seeking Alpha

- Prudential: Positioned To Benefit From A Long-Term Interest Rate Reversion by Kody's Dividends at Seeking Alpha

- Waste Management, Inc. (WM) Dividend Stock Analysis by D4L at Dividend Growth Stocks

- High Quality Dividend Growth Stock for March 2021: PepsiCo (PEP) by David Van Knapp, at Daily Trade Alert

- Broadcom: A Wonderful Hyper-Growth Blue Chip At A Fair Price by Brad Thomas at Seeking Alpha

Thanks for stopping by, have a nice next week!

No comments:

Post a Comment