Yesterday on 29th September I added 20 shares of Scotiabank (BNS) at CA$ 70.73 per share plus commission (CA$ 5.00). My overall cost basis of this position increases from CA$ 61.96 to CA$ 63.12 per share. I totally hold now 155 shares of BNS and my yield on cost is 4.69%. In March 2014 I purchased my first BNS shares, you can look this purchase of BNS here.

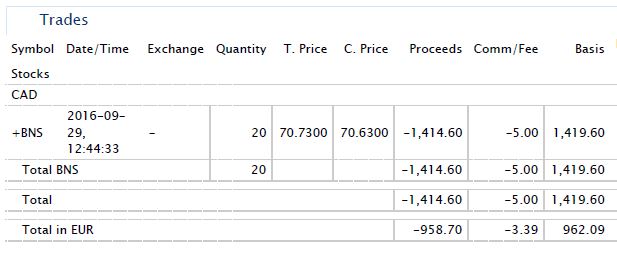

Details of my purchase:

With current quarterly dividend (CA$ 0.72), my last purchase 20 shares of BNS increases € 29.80 (CA$ 42.91) of expected annual net dividend income.

At today's exchange rate, this purchase will increase my portfolio projected annual net dividend income approximately to € 9270.00.

Click here

to see my portfolio.

Full Disclosure: Long BNS

Thanks for stopping by!

Thanks for stopping by!

Looks like you picked up the shares I sold :)

ReplyDeletehttp://roadmap2retire.com/2016/09/recent-sell-10/

Best wishes

R2R

DHawk -

ReplyDeleteDayum! Talk about a huge position you have there, congrats on the purchase, love those Canadian banks!

-Lanny

Nice purchase, i am watching this to see if i want to increase my holdings.

ReplyDeletegood luck

I purchased CNI

ReplyDeleteThis is the first time in a while that I have been reading almost simultaneous sells and buys of the same stock. Usually, among our fellow dividend peers we tend to either collectively buy or collectively sell, more or less. I'm still holding my BNS though have no plans to add at current levels. Thanks for sharing.

ReplyDeleteGreat to see a nice common sense. Banks will always survive. Governments will never let them down, so the only danger here is if they stop paying the dividends, like Citigroup or BofA (both already reinstated the dividend). But they will survive.

ReplyDeleteGood buy. on my watchlist along with a few others

ReplyDeleteNice buy -- thanks for sharing. I don't own BNS yet but it looks interesting!

ReplyDeletedear dividend hawk,

ReplyDeletewhat broker are you using for investing internationally? I am from Asian country and would like to invest in USA's stocks... do you have broker recommendation?

thanks!

Hi, I'm using LYNX broker (lynxbroker.com)I don't have any recommendation, but maybe Interactive Brokers (interactivebrokers.com) is worth of looking.

DeleteCheers,

DH