I did 24 transactions during the year, 21 purchases and 3 sales , I got dividends from 21 companies.

In January, I sold my 200 Orion's shares. because in my view, their value had risen too high. I left, however, a further 300 Orion's shares in my portfolio, because I still believe in Orion's ability to pay good dividends. In February, I sold about 73% of the SP corporate bond fund, because I wanted to move the weight more on direct equity investments. The third-sales I made in December, I reduced the number of my holding in Tele2, from my 500 shares, I sold 300 shares, because I'm a little skeptical of Tele2's ability to pay good dividends for years to come. These sales generated a total of €8,069 income, after-tax, my net income will be € 5,648.44.

During the year 2013 I bought the following stocks and ETFs

Fortum Corporation (FUM1V) 300

Global X SuperDividend ETF (SDIV) 600

Nordic Mining (NOM.OL) 14731

Oriflame Cosmetisc SA (ORI SDB.ST) 300

Aleria MLP ETF (AMLP) 500

Kraft Foods Group Inc. (KRFT) 100

Golar LNG (GLNG) 300

AT & T (T) 130

Pfizer Inc. (PFE) 200

Altria Group Inc. (MO) 175

Prosafe SE (PRS.OL) 300

The Coca-Cola Company (KO) 150

Tal International Group Inc. (TAL) 100

Digital Realty Trust, Inc. (DLR) 120

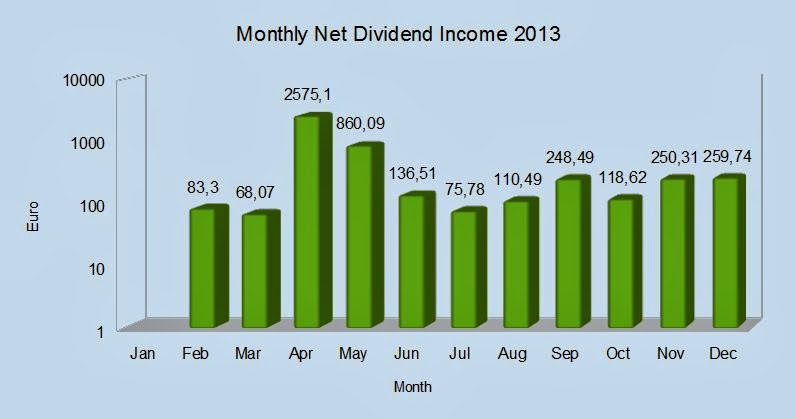

I used total money of €67,974.85 to the new share and ETF purchases over the past years, sale of funds and shares gave me €29,597.21. In addition, one of my term deposit matured during the year, the value of € 20k, which I used for the purchase of new shares over the last year. Almost all of the dividends that I received during the year 2013, a total of € 4,786.51, I reinvested.

My goal is to have a dividend yield of € 6,000 over the next year and increase the value of my portfolio, so that in 2015, my dividend income would be € 7,500. Also aims to diversify the ownership more geographically and add at least one new currency in my portfolio. My intention is to acquire shares in the Canadian and British exchanges.

Happy New Year to all, and successful investments in 2014

Congratulations, DH. Lots of strong names in your portfolio. And thats an impressive amount of money that you've poured into your investments.

ReplyDeleteUpwards and onwards to higher goals.

Happy new year. Best wishes

Thanks again for your comment R2R

DeleteMy last year was quite ferocious when it comes to new share purchases and absolutely unusual, as I moved my savings more in individual stocks. Time will show whether it is good or bad move.

Happy New Year to you, too

Congratulations on your blog, I've known this now and I like it a lot, follow the same strategy with a capital although much smaller, but hopefully year after year reinvesting my dividends as you can achieve economic independence.

ReplyDeleteGreetings from Spain.

Hi Magallanes I

DeleteThanks for your greetings.

At the beginning everyone are small, but with time, the stream of dividends will grow up, if you are able to pick up good companies.

DH

Hiya DividendHawk, I was referred to your site! Your project looks great, keep up the good work. I am a dividend growth investor myself and currently I am looking for companies which pay euro dividends on a quarterly or semi-annually basis. I am looking for a constant dividend income from both my USD and EUR-listed stocks. Thanks for helping me out!

ReplyDeleteHi Robin

DeleteI read your blog post and I shared it on twitter as well, in the hope that someone would give you some tips. In my portfolio there is only one European company that pays quarterly dividends, Prosafe SE from Oslo stock exchange and it pays in NOK, not in EUR, so it does not meet your requirements. In any case, good if I helped you somehow.

DH

Thanks for taking the time to help me out! I guess dividends in NOK would be my choice of currency after the English pound and the Swiss franc ;) Let me know if you heard any good advice on Twitter.

DeleteBest regards,

Robin

Hi DH !

ReplyDeleteYour portfolio seems great.

Happy new year!