The second quarter has already passed and it is time to look at how it went and how I managed in my saving goals and how my journey towards financial independence is progressing. Since this is the third year when I keep a stricter control of my spending, I also made a comparison with last year's results. As I mentioned in my first income / expenditure report, I will make a summary on a quarterly basis, because my months in the case of income are very different. This will give me a better view of the overall situation and hopefully will inspire some of my blog readers.

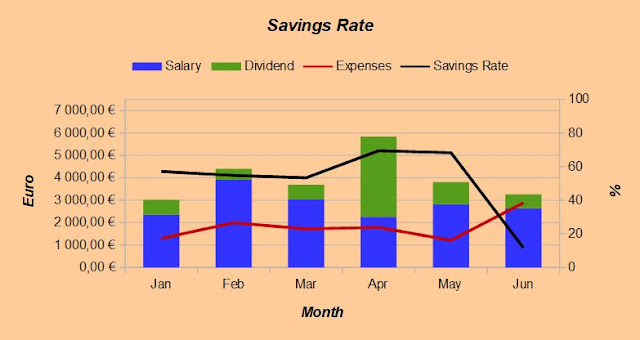

Here are my numbers for Q2:

All revenues are reported net of taxes.

During the second quarter the wage income was a bit higher as normal, because in May and in June I again did some overtime work. Expenditure in June and in April was higher than my normal. June, when spending was much higher than usual, includes a prepayment for the upcoming holiday trip, as well as "extra" health care expenses totaling around 1350 euros. However, it is clear to see that my expenses are continuing to grow and the direction should be able to turn around.

My goal is to save about half of my wage income and invest it. In the second quarter I was really far from my goal, my saving rate of wage income was only 23.91%. When I take into account also the dividend income, my savings rate rises to 54.49%.

One thing that I will follow with great interest is the dividend income and expenditure ratio, because it is the most important thing on my way towards to the financial independence.

The second quarter was excellent for dividend earnings, due to the great April. However, high expenses for the quarter occurred it, that the dividend income covered for about 88% of my expenditure.

Let's take a look how was my first half of 2017:

My expenses were an average of 1814 Euros and my salary was an average 2837 Euros per month. As you can see, during the first part of year, I was able to save only 36.04% of my wage income, which is well below my target. Of the total income my savings rate in the first half of the year was 54.69%.

Thanks to the excellent dividend income in the second quarter, almost 65 percent of my expenses I was able to cover with the dividend income during the first half of the year.

Comparison between 2016 and 2017:

As you can see, during the first half of the year my

dividend income grew only about 5 per cent, even I made several

acquisitions during the last few months. Despite the

recent acquisitions and the latest dividend increases of a some companies,

the growth of dividends in the euro has been fairly modest as the Euro has

strengthened by about 10% YTD against the dollar. Wage income compared to last year were a bit

higher, for the simple reason that I did more overtime work. Due to the high

increase in spending, my savings to wage income went down 13.54%, it was only 36.04% for the first six months. Of my expenses, dividend income accounted for

about 6 percent less than the year before, so the journey towards financial

independence seems to be rather more distant than closer.

I look forward to what the next quarter will look like. In

the third quarter dividend income should be at the same level as in the first quarter. Wage income should be

close to normal (2k EUR per month) and expenditure hopefully much less than

at the beginning of the year, although the vacation (5 weeks) is usually a

period when money is spent more as at other times.

Thanks for stopping by!

Photo

Credit: Stuart Miles/FreeDigitalPhotos.net

These are the most interesting posts. Keep 'em coming! If your savings rate is above 50% (dividends reinvested), I'm sure you'll reach FI soner rather than later. According to the famous 4% rule you'd need 45000 to cover those 1800 monthly expesens. That would of course require you to sell some of the assets to draw that 4% or are you planning to live on dividends alone some day? In that case the joyrney will be longer..

ReplyDelete