Welcome and thanks for reading!

In this review, I will make a summary of important and interesting news and events over the last week related to my portfolio holdings. Also, I will put together some interesting articles from other websites that caught my attention during the past week.

Received Dividends:

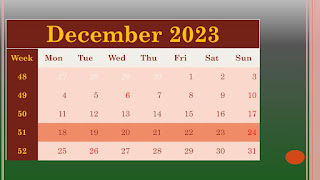

December 18, 2023

- €24.45– Duke Energy Corporation (DUK)

- €14.47– NextEra Energy, Inc. (NEE)

- €20.22– Viatris Inc. (VTRS)

- €47.09– The Coca-Cola Company (KO)

- €22.80– McDonald's Corporation (MCD)

- €29.03– Flowers Foods, Inc. (FLO)

- €24.85– Main Street Capital (MAIN)

- €33.20– Realty Income Corporation (O)

December 19, 2023

- €80.46– Kesko Corporation (KESKO)

- €3.73– Kontoor Brands, Inc. (KTB)

- €62.33– Manulife Financial Corporation (MFC)

December 20, 2023

- €18.08– Dominion Energy, Inc. (D)

- €5.18– V.F. Corporation (VFC)

Week 51: Total net dividends €385.89

Dividend income is reported after the deduction of taxes. Check more at my Monthly Dividend sheet.

My Portfolio's Transactions:

December 20, 2023

- I opened a new position and purchased 50 shares of Global Equity Premium Income UCITS ETF (JGPI.DE) at €23.20 per share plus commission.

Global Equity Premium Income UCITS ETF is a global equity version of the group’s hugely popular US-listed JPMorgan Equity Premium Income ETF (JEPI), a US-equity strategy that has amassed $30bn assets under management (AUM) since launching in May 2020. It offers investors a consistent income of 7-9% a year, paid monthly, while delivering less volatility versus its benchmark, the MSCI World index. The JPMorgan Global Equity Premium Income UCITS ETF is listed on the London Stock Exchange (JEPG) and on the Deutsche Boerse (JGPI) with a total expense ratio (TER) of 0.35%.

Portfolio Holdings News:

December 18, 2023

- Unilever PLC to sell Elida Beauty business to Yellow Wood Partners; Unilever has today announced that it has received a binding offer from Yellow Wood Partners LLC to acquire Elida Beauty. The binding offer is subject to the usual closing conditions, regulatory requirements, and consultation processes. Completion is expected by mid-2024. Financial terms of the binding offer are undisclosed.

- Lockheed Martin Corporation (LMT) and Lockheed Martin Aeronautics have been awarded a $138.46 million cost-plus-fixed-fee undefinitized contract to procure various special tooling and special test equipment in support of production, retrofit modifications and flight test instrumentation for the Joint Strike Fighter aircraft for the Air Force, Marine Corps, Navy, Foreign Military Sales customers and non-U.S. Department of Defense participants and has secured a $663.13 million modification to a previously awarded cost-plus-incentive-fee, fixed-price-incentive, cost reimbursable contract.

- Archer-Daniels-Midland Company (ADM) to Acquire Revela Foods; ADM announced it is adding to its flavors capabilities with an agreement to acquire Revela Foods, a Wisconsin-based developer and manufacturer of innovative dairy flavor ingredients and solutions. ADM intends to complete the transaction early in 2024.

December 19, 2023

- NCC AB (NCC) to construct 285 apartments for Birger Bostad in Solna; NCC has been commissioned by Birger Bostad, part of Fabege, to construct 285 apartments in the Haga Norra city neighborhood in Arenstaden, Solna. The project is a turnkey contract in partnering form with an order value of approximately SEK 450 million.

- NN Group N.V. (NN.AS) completes two longevity transactions; NN announces today that its subsidiary NN Life has completed two transactions to transfer the full longevity risk associated with in total approximately EUR 13 billion of pension liabilities in the Netherlands. The deals will reduce NN’s exposure to longevity risk and thereby further strengthen NN’s capital position.

- Archer-Daniels-Midland Company (ADM) to Acquire UK-Based FDL; ADM has reached an agreement to acquire UK-based FDL, a leading developer and producer of premium flavor and functional ingredient systems. ADM intends to complete the transaction by end of January 2024.

December 20, 2023

- Neste Corporation’s (NESTE) crude oil refinery in Finland to be gradually transformed into a renewables and circular solutions refining hub; NESTE begins a gradual transformation of its crude oil refinery in Porvoo, Finland into a leading renewable and circular solutions refining hub. The planned transformation will proceed in phases, and requires multiple separate investment decisions during the next decade before targeted completion in the mid 2030s. The total investment estimate for the transformation roadmap is approximately 2.5 BEUR.

- NCC AB (NCC) to build head office for Bosch in Denmark; NCC is to build a new headquarters for Bosch in Ballerup near Copenhagen, Denmark. The office building covers approximately 10,000 square meters distributed over three floors and will accommodate all the company's employees, who are currently residing in two separate offices.

- WEC Energy Group, Inc. (WEC) Announces Plan to Increase Dividend; The board of directors of WEC announced that it is planning to raise the quarterly dividend on the company's common stock to 83.50 cents per share in the first quarter of 2024. This would represent an increase of 5.5 cents per share, or 7 percent.

- General Mills, Inc. (GIS) Reports Fiscal 2024 Second-quarter Results; GIS reports Non-GAAP EPS of $1.25, beating analyst estimates by $0.09 and increased 14% year-over-year. Revenue of $5.1 billion misses analyst estimates by $260 million and decreased 2% versus the same quarter last year. Management guides Organic net sales to range between down 1 percent and flat, compared to the previous range of 3 to 4 percent growth, reflecting a slower volume recovery in fiscal 2024. Adjusted operating profit and adjusted diluted EPS are now expected to increase 4 to 5 percent in constant currency.

- Lockheed Martin Corporation (LMT) was awarded a $220.7M modification to a cost-plus-fixed-fee, firm-fixed-price order against a previously issued basic ordering agreement.

- General Dynamics Corporations (GD) Mission Systems–Canada Awarded four Land C4ISR Contracts for the Canadian Army; GDs Mission Systems–Canada announced today that it was awarded four contracts cumulatively valued at up to CA$1.68 billion (US$1.3 billion) by the Government of Canada to support the Land Command, Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance (C4ISR) system for the Canadian Army.

December 21, 2023

- Cisco Systems, Inc. (CSCO) to Acquire Isovalent; CSCO announced the intent to acquire Isovalent, a leader in open source cloud native networking and security, to bolster its secure networking capabilities across public clouds. CSCO did not disclose terms of the deal, which is expected to close in Q3 2024.

- RTX Corporation's (RTX) Raytheon Missiles and Defense segment awarded a $407.60M cost-plus-fixed-fee modification to a previously awarded task order for the Hypersonic Attack Cruise Missile-Southern Cross Integrated Flight Research Experiment.

- Royal Bank of Canada (RY) receives approval to proceed with acquisition of HSBC Canada; Canada has approved RY's acquisition of HSBC's (NYSE:HSBC) Canadian unit for $10.2B, which is subject to certain conditions imposed on the acquirer. RY expects to close the deal in Q1 2024.

December 22, 2023

- Unilever to acquire premium haircare brand K18; Unilever today announced it has signed an agreement to acquire the premium biotech haircare brand K18. K18 is distributed through professional salons, retail, and eCommerce primarily in North America, UK and Australia. Terms of the deal were not disclosed. The transaction is expected to close in Q1 2024.

- ConocoPhillips (COP) Makes Final Investment Decision to Develop the Willow Project; COP announced it would move forward with its huge $7.5B Willow undertaking in Alaska, paving the way for the production of about 600M barrels across the lifetime of the project.

- Bristol-Myers Squibb Company (BMY) to Acquire Karuna Therapeutics; BMY and Karuna Therapeutics, Inc. (NASDAQ: KRTX) announced that they have entered into a definitive merger agreement under which Bristol Myers Squibb has agreed to acquire Karuna for $330.00 per share in cash, for a total equity value of $14.0 billion, or $12.7 billion net of estimated cash acquired. The transaction was unanimously approved by both the Bristol Myers Squibb and Karuna Boards of Directors. The deal is expected to close in 1H of next year and includes $1.27 billion in cash that Karuna has on hand. The transaction is expected to be dilutive to Bristol Myers (BMY) non-GAAP diluted earnings per share by approximately $0.30 in 2024 from the financing cost of the transaction.

- Lockheed Martin Corporation's (LMT) Lockheed Martin Rotary and Mission Systems was awarded a $141.51M cost-plus-incentive-fee modification to a previously awarded contract.

- RTX Corporation's (RTX) Raytheon Missile Systems was awarded a $155.70M firm-fixed-price undefinitized order against a previously issued basic ordering agreement.

Articles that caught my attention:

- Undervalued Dividend Growth Stock of the Week: Xylem (XYL) by Jason Fieber at Daily Trade Alert

- Guesswork don’t work on the Sunday Reads by Dale Roberts at Cut the Crap Investing

- Why I Recently Sold Ares Capital Corp Stock by Samuel Smith at Seeking Alpha

- Philip Morris, British American Tobacco And Altria: A Slow March To The Grave For All 3 Or Only Some? by Young Investor Analytics at Seeking Alpha

- Bristol Myers Squibb: This Dividend Contender Is A Steal Right Now by The Dividend Collectuh at Seeking Alpha

- Create Wealth With A Long Term HEICO Investment by Charles Fournier at Financial Freedom Is A Journey

- What Would Make Mike Switch Strategies – ETFs vs Dividend Growers [Podcast] by DivGuy at The Dividend Guy Blog

- Utility Stocks for Income and Growth Thanks to Rising Interest Rates by Chuck Carnevale of FAST Graphs at Daily Trade Alert

- Trade Alert: Why I Sold Home Depot by Nicholas Ward at Seeking Alpha

- Stock Valuation: An Overview by Dividend Monk

- 10 Safest Dividend Stocks For 2024 by Bob Ciura at Sure Dividend

- High-Yield Stock of the Month for January 2024 by Jason Fieber at Daily Trade Alert

- McDonald's Corporation (MCD) Dividend Stock Analysis by D4L at Dividend Growth Stocks

- 29 Undervalued Dividend Aristocrats: December 2023 by FerdiS at Seeking Alpha

Thanks for stopping by, Merry Christmas and Happy Holidays Everyone!

Didn't mention JGPI's effect on your dividends this time, so I assume you bought the accumulating version? If not, the etf's domicile is in Ireland, therefore don't you lose some of the dividends in taxation?

ReplyDeleteHi, it's not yet clear how much JGPI pays in dividends, but as I mentioned the US listed version pays around 7-9%. The income paid by the ETF is interest income for me, on which I pay 30% tax to Finland.

DeleteCheers,

DH

Hi, I've been following you for a while and your dividend based tactic matches mine pretty much. As a Finn, I would like to ask if you keep stocks in a "AO-tili"? In Finland, part of the dividends goes to taxes, unlike in some other countries (or states in US).

ReplyDeleteHello, yes all my shares are in an "AO tileillä" Tällä hetkellä kolmella eri välittäjällä, Danske, Nordnet ja Nordea

DeleteRegards,

DH

Where to find information about JPGI? What are holdings of the ETF?

ReplyDeleteHi, for example here (https://am.jpmorgan.com/fi/en/asset-management/adv/products/jpm-global-equity-premium-income-ucits-etf-usd-dist-ie0003uvyc20#/overview) and here (https://europeandgi.com/etf/jepg-etf/)

DeleteCheers,

DH

Thanks, appreciated!

ReplyDelete