Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week

related to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Dividends from My Portfolio Holdings:

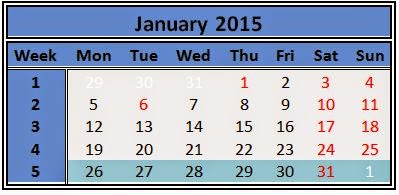

- On January 26 I received a dividend of € 27.45 from General Electric Co.

- On January 30 I received a dividend of € 34.42 from Bank of Nova Scotia.

Dividend income reported after the deduction of taxes. I have

also updated my Monthly

Dividend sheet.

Transactions of My Portfolio:

- On January 29, 2015 I bought 60 shares of AT&T Inc. (More here)

News from My Portfolio Holdings:

AT&T Inc. January 26, 2015

- AT&T to Acquire Nextel Mexico (More here)

NCC: January 27, 2015, Fourth Quarter and Full Year 2014

Results (More here)

October 1 – December 31, 2014

- Orders received SEK 18,469 M (14,363)

- Net sales SEK 18,760 M (21,073)

- Profit after financial items SEK 1,017 M (1,472)

- Profit after tax for the period SEK 878 M (1,231)

- Earnings per share SEK 8.13 (11.39)

January 1 – December 31, 2014

- Orders received SEK 61,379 M (56,979)

- Net sales SEK 56,867 M (57,823)

- Profit after financial items SEK 2,234 M (2,400)

- Profit after tax for the period SEK 1,838 M (1,989)

- Earnings per share SEK 17.01 (18.40)

- The Board proposes a dividend of SEK 12.00 (12.00) per share for 2014, divided into two payments

Pfizer Inc. January 27, 2015, Fourth Quarter and Full Year

2014 Results (More here)

- Fourth-Quarter 2014 Reported Revenues of $13.1 Billion; Full-Year 2014 Reported Revenues of $49.6 Billion

- Fourth-Quarter 2014 Adjusted Diluted EPS of $0.54, Reported Diluted EPS of $0.19; Full-Year 2014 Adjusted Diluted EPS of $2.26, Reported Diluted EPS of $1.42

- Repurchased $1.2 Billion and $5.0 Billion of Common Stock in Fourth-Quarter and Full-Year 2014, Returned Nearly $12 Billion to Shareholders Through Share Repurchases and Dividends in 2014

- 2015 financial guidance, including ranges for reported revenues of $44.5 to $46.5 billion and for adjusted diluted EPS of $2.00 to $2.10

AT&T Inc. January 27, 2015, Fourth Quarter and Full

Year 2014 Results (More here)

- Full-Year 2014: Consolidated Revenues of $132.4 Billion, Up 3.1 Percent when Adjusting for Sale of Connecticut Assets

- Due to non-cash charges, loss of $0.77 per share in the fourth quarter compared to $1.31 diluted EPS in the year-ago quarter. Excluding significant items, EPS was $0.55 versus $0.53 a year ago, up 3.8 percent

- Fourth-quarter consolidated revenues of $34.4 billion, up 3.8 percent versus the year-earlier period and up 4.5 percent when adjusting for the sale of Connecticut wireline properties; full-year revenues up 2.9 percent, 3.1 percent when adjusted

- Full-year capital investment of more than $21 billion while exceeding Project VIP objectives

- More than $11 billion returned to shareowners in 2014 through dividends and share repurchases

- More than 2 million new wireless and wireline high-speed broadband connections added in the fourth quarter

TeliaSonera: January 29, 2015, Fourth Quarter and Full

Year 2014 Results (More here)

Fourth Quarter Summary

- Net sales in local currencies, excluding acquisitions and disposals, decreased 2.2 percent. In reported currency, net sales increased 0.2 percent to SEK 26,606 million (26,560). Service revenues in local currencies, excluding acquisitions and disposals, decreased 2.2 percent.

- EBITDA, excluding non-recurring items, decreased 3.5 percent in local currencies, excluding acquisitions and disposals. In reported currency, EBITDA, excluding non-recurring items, decreased 1.4 percent to SEK 8,604 million (8,728). The EBITDA margin, excluding non-recurring items, decreased to 32.3 percent (32.9).

- Operating income, excluding non-recurring items, decreased 4.8 percent to SEK 6,757 million (7,100).

- Net income attributable to owners of the parent company increased 34.2 percent to SEK 2,938 million (2,190) and earnings per share to SEK 0.68 (0.51).

- Free cash flow decreased to SEK 1,635 million (2,126) due to changes in working capital.

Full Year Summary

- Net sales in local currencies, excluding acquisitions and disposals, decreased 1.8 percent. In reported currency, net sales decreased 0.8 percent to SEK 101,060 million (101,870). Service revenues in local currencies, excluding acquisitions and disposals, decreased 1.0 percent.

- Net income attributable to owners of the parent company decreased 3.1 percent to SEK 14,502 million (14,970) and earnings per share to SEK 3.35 (3.46).

- Free cash flow decreased to SEK 13,046 million (16,310) due to higher cash CAPEX and changes in working capital.

- The board of Directors proposes an ordinary dividend of SEK 3.00 per share (3.00), totaling SEK 13.0 billion (13.0) or 90 percent (87) of net income attributable to owners of the parent company.

ConocoPhillips: January 29, 2015, Fourth Quarter and Full

Year 2014 Results (More here)

- ConocoPhillips today reported a fourth-quarter 2014 net loss of $39 million, or $0.03 per share, compared with fourth-quarter 2013 earnings of $2.5 billion, or $2.00 per share. Excluding special items, fourth-quarter 2014 adjusted earnings were $0.7 billion, or $0.60 per share, compared with fourth-quarter 2013 adjusted earnings of $1.7 billion, or $1.40 per share. Special items for the current quarter primarily related to the Freeport LNG termination agreement and non-cash impairments.

- Full-year 2014 earnings were $6.9 billion, or $5.51 per share, compared with full-year 2013 earnings of $9.2 billion, or $7.38 per share. Excluding special items, full-year 2014 adjusted earnings were $6.6 billion, or $5.30 per share, compared with full-year 2013 adjusted earnings of $7.1 billion, or $5.70 per share.

- In anticipation of weak 2015 commodity prices, the company has further reduced its expected 2015 capital expenditures to $11.5 billion from the $13.5 billion previously announced. Reductions since the December capital announcement will come primarily from the deferral of onshore drilling and exploration programs in the Lower 48, and deferral of major project spending. At this level of capital, the company expects to achieve 2 to 3 percent production growth in 2015 from continuing operations, excluding Libya.

- “We are responding decisively to a weak price outlook in 2015 by exercising our capital and balance sheet flexibility,” said Ryan Lance, chairman and chief executive officer. “In this environment our priorities are to protect our dividend and base production, stay on track for cash flow neutrality in 2017, and preserve future opportunities.”

Tele2: January 30, 2015, Fourth Quarter and Full Year

2014 Results (More here)

|

| Source: Tele2 Interim Report |

- The Board has decided to amend the progressive dividend policy to an annual 10 percent dividend growth for the coming 3 years. The Board therefore recommends an ordinary dividend of SEK 4.85 (4.40) per share in respect of the financial year 2014.

Chevron Corporation: January 30, 2015, Fourth

Quarter and Full Year 2014 Results (More here)

- Chevron reported earnings of $3.5 billion ($1.85 per share – diluted) for fourth quarter 2014, compared with $4.9 billion ($2.57 per share – diluted) in the 2013 fourth quarter. Foreign currency effects increased earnings in the 2014 quarter by $432 million, compared with an increase of $202 million a year earlier.

- Full-year 2014 earnings were $19.2 billion ($10.14 per share – diluted) compared with $21.4 billion ($11.09 per share – diluted) in 2013.

- Sales and other operating revenues in fourth quarter 2014 were $42 billion, compared to $54 billion in the year-ago period.

Altria Group Inc. January 30, 2015, Fourth Quarter and

Full Year 2014 Results (More here)

- Altria’s 2014 fourth-quarter reported diluted earnings per share (EPS) increased over 100% to $0.63, as comparisons were affected by special items.

- Altria’s 2014 fourth-quarter adjusted diluted EPS, which excludes the impact of special items, increased 15.8% to $0.66.

- Altria’s 2014 full-year reported diluted EPS increased 13.3% to $2.56, as comparisons were affected by special items.

- Altria’s 2014 full-year adjusted diluted EPS, which excludes the impact of special items, increased 8.0% to $2.57.

- Altria forecasts its 2015 full-year adjusted diluted EPS to be in the range of $2.75 to $2.80, representing a growth rate of 7% to 9% from an adjusted diluted EPS base of $2.57 in 2014.

- Altria’s President and Chief Operating Officer, Dave Beran, has decided to retire on March 1, 2015, after 38 years with the company. Howard Willard, currently Altria’s Chief Financial Officer, will become Chief Operating Officer. William Gifford, currently Altria’s Senior Vice President, Strategy & Business Development, will become Chief Financial Officer. These changes are also effective March 1, 2015.

Chevron Corporation: January 30, 2015

- Chevron Announces $35.0 Billion Capital and Exploratory Budget for 2015. (More here)

Articles that caught my attention:

- Dividend Stocks – How to Invest When Valuations Are Expensive by Ken Faulkenberry

- Work And Financial Independence Are Not Mutually Exclusive by Dividend Mantra

- How to never run out of money in retirement by Dividend Growth Investor

- Is a PepsiCo Spin Off Coming? by Roadmap2Retire

- 4 Resources To Learn From Warren Buffett by Ben Reynolds on Sure Dividend

- Novo Nordisk - Curing the World one Dose at a Time by jussi hakala on My Road to Half a Million

- How to start investing in dividend paying stocks by Mark on My Own Advisor

- 10 Dividend Aristocrats With The Highest Possibility To GrowDividends At The Fastest Pace by Tom Roberts on Dividend Yield - Stock, Capital, Investment

- The Graham Formula Applied to Dividend Aristocrats by Ben Reynolds on Sure Dividend

- Is Now A Good Time To Buy STAG? by Brad Thomas on Seeking Alpha

- Boeing Co. – Dividend Fact Sheet by Dividend Engineering

- HCP Inc (HCP) A High Yield REIT Play on Healthcare by Dividend Growth Investor

- These 15 Europe Dividend Stocks Could Gain Mostly From A RisingDollar by Tom Roberts on Dividend Yield - Stock, Capital, Investment

- Chevron Below $100 Per Share Is Blue-Chip Value Investing by Tim McAleenan Jr. on The Financial Home Of Tim McAleenan Jr.

I wish all readers a nice next week.

Thanks for putting together another great list, DH!

ReplyDeleteThanks for including my PepsiCo article, DH. Appreciate the support.

ReplyDeleteR2R

Thank you for including my Dividend Stocks - How to Invest When Valuations Are Expensive post. Much Appreciated!

ReplyDeleteKen

Great list of articles.Thank you for taking the time putting them together and sharing them with us.

ReplyDelete