Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week related

to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

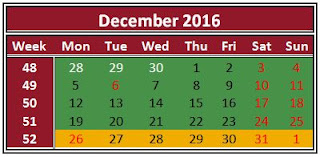

Saturday, December 31, 2016

Friday, December 30, 2016

Recent Buy - Cisco Systems, Inc. (CSCO)

Today I made my last purchase for this year, I Bought 35 shares of Cisco Systems,

Inc. at $ 30.28 per share plus commission.

My overall cost basis of this position increases from $ 27.33 to $ 28.05 per share. I totally hold now 150 shares of CSCO and my yield on cost is 3.71%. You can look at my first purchase of CSCO here.

My overall cost basis of this position increases from $ 27.33 to $ 28.05 per share. I totally hold now 150 shares of CSCO and my yield on cost is 3.71%. You can look at my first purchase of CSCO here.

Monday, December 26, 2016

Week in Review 51/16

Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week

related to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Sunday, December 25, 2016

Recent Buy - Algonquin Power & Utilities Corp (AQN.TO)

On Friday, December 23, I bought 100 shares of Algonquin Power & Utilities Corp. at CA$ 11.43 per share plus commission.

My overall cost basis of this position decreases from CA$ 11.80 to CA$ 11.72 per share. I totally hold now 400 shares of AQN and my yield on cost is 4.90%. I purchased my first AQN's shares a couple of months ago, you can read my first acquisition of AQN here.

My overall cost basis of this position decreases from CA$ 11.80 to CA$ 11.72 per share. I totally hold now 400 shares of AQN and my yield on cost is 4.90%. I purchased my first AQN's shares a couple of months ago, you can read my first acquisition of AQN here.

Friday, December 23, 2016

Recent Buy - W. P. Carey Inc. (WPC)

Yesterday on 22nd December I Bought 17 shares of W. P.

Carey Inc. at $ 58.52 per share plus commission.

My overall cost basis of this position decreases from $

61.56 to $ 60.57 per share. I totally hold now 47 shares of WPC and my yield on

cost is 6.54%. I purchased my first WPC's shares about one and half year ago,

you can read my first acquisition of WPC here.

Thursday, December 22, 2016

Recent Buy - General Electric Company (GE)

Yesterday on 21st December I Bought 30 shares of General Electric Company at $ 32.08 per share plus commission.

My overall cost basis of this position increases from $ 25.58 to $ 26.53 per share. I totally hold now 210 shares of GE and my yield on cost is 3.62%. I purchased my first GE's shares over two years ago, you can read my first acquisition here.

My overall cost basis of this position increases from $ 25.58 to $ 26.53 per share. I totally hold now 210 shares of GE and my yield on cost is 3.62%. I purchased my first GE's shares over two years ago, you can read my first acquisition here.

Sunday, December 18, 2016

Week in Review 50/16

Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week

related to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Tuesday, December 13, 2016

Dividend Increase – Pfizer Inc. (PFE)

Yesterday the board of directors of Pfizer Inc. announced a quarterly dividend increase of from $ 0.30 to $ 0.32 per share that’s payable March 1, 2017 to holders of record February 3, 2017. This represents a 6.67% increase to regular quarterly dividends.

With current price $ 32.40 (yesterday's close), this raise

brings their dividend yield to 3.95%.

Since I own 200 shares this will increase my yearly net

dividends by $ 11.92.

Sunday, December 11, 2016

Week in Review 49/16

Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week

related to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Saturday, December 10, 2016

Dividend Increase – General Electric Co. (GE)

Yesterday on December 9 General Electric Co. announced a quarterly dividend increase of from $ 0.23 to $ 0.24 per share that’s payable January 25, 2017 to holders of record December 27, 2016. This represents a 4.35% increase to regular quarterly dividends. With current price $ 31.78 (yesterday's close), this raise brings their dividend yield to 3.02%.

Since I own 180 shares, this will increase my yearly net

dividends by $ 5.36.

That increase rises my YOC to 3.75%

Click here

to see my portfolio holdings.

Thanks for stopping by!

Thursday, December 8, 2016

Dividend Income - November 2016

Again, one month passed and it is time to report my

dividend income. In November 2016 my portfolio dividend income was as follows:

Annual dividend received from:

NCC AB B (NCC-B) - € 89.69 ($ 99.54)

Oriflame Hld (ORI) - € 59.85 ($ 63.84)

Quarterly dividends received from:

Annual dividend received from:

NCC AB B (NCC-B) - € 89.69 ($ 99.54)

Oriflame Hld (ORI) - € 59.85 ($ 63.84)

Quarterly dividends received from:

AT&T Inc. (T) - €135.53 ($ 148.80)

AbbVie Inc. (ABBV) - € 15.95 ($ 17.10)

AbbVie Inc. (ABBV) - € 15.95 ($ 17.10)

Kinder Morgan Inc. (KMI) - € 23.37 ($ 25.01)

ONEOK Inc. (OKE) - € 28.64 ($ 30.75)

ONEOK Inc. (OKE) - € 28.64 ($ 30.75)

Omega Healthcare Investors (OHI) - € 85.34 ($ 91.50)

Emera Incorporated (EMA.TO) - € 29.08 ($ 31.13)

Eaton Corporation (ETN) - € 16.15 ($ 17.10)

Emera Incorporated (EMA.TO) - € 29.08 ($ 31.13)

Eaton Corporation (ETN) - € 16.15 ($ 17.10)

HCP Inc. (HCP) - € 34.91 ($ 37.00)

Royal Bank of Canada (RY.TO) - € 69.43 ($ 73.82)

Alerian MLP ETF (AMLP) - € 113.28 ($ 120.00)Tuesday, December 6, 2016

Recent Buy - Gilead Sciences Inc. (GILD)

Yesterday on 5th December I Bought 15 shares of Gilead Sciences Inc. at $ 71.95 per share plus commission.

My overall cost basis of this position decreases from $ 80.14 to $ 76.77 per share. I totally hold now 35 shares of GILD and my yield on cost is 2.45%. You can look at my first purchase of GILD here.

My overall cost basis of this position decreases from $ 80.14 to $ 76.77 per share. I totally hold now 35 shares of GILD and my yield on cost is 2.45%. You can look at my first purchase of GILD here.

Sunday, December 4, 2016

Week in Review 48/16

Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week

related to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Thursday, December 1, 2016

Recent Buy - Flowers Foods, Inc. (FLO)

29th November I added 60 shares of Flowers Foods Inc. (FLO) at $ 15.69 per share plus commission ($ 5.00). My overall cost basis of this position increases from $ 15.09 to $ 15.31 per share. I totally hold now 185 shares of FLO and my yield on cost is 4.18%. You can look at my first purchase of FLO here.

Subscribe to:

Comments (Atom)