Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week

related to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Sunday, May 31, 2015

Friday, May 29, 2015

Recent Buy - TELUS Corporation (NYSE:TU, TSE:T)

My overall cost basis of this position decreases from $34.00 to $33.88 per share. I totally hold now 100 shares of TU and my yield on cost is 3.97%. You can look at my first purchase of TU here.

At today's exchange rate, this purchase 50 shares of TU will increase €45.82 ($50.28) of my expected annual net dividend income and will increase my portfolio's projected annual net dividend income to €9260.00.

Click here

to see my portfolio.

Full Disclosure: Long TU

Sunday, May 24, 2015

Week in Review 21/15

Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week

related to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Sunday, May 17, 2015

Week in Review 20/15

Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week

related to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Thursday, May 14, 2015

Recent Buy - Omega Healthcare Investors Inc. (OHI)

13th May 2015 I Bought 55 shares of OHI at $34.96 per

share plus commission.

Some weeks ago, I made my first purchase of OHI. After

that, its price has continued to go down, like many other REITs also, so I

decided to take a little more of it. My overall cost basis of this position

decreases from $38.04 to $36.40 per share. I totally hold now 100 shares of OHI

and my yield on cost is 5.93%. You can look at my first purchase of OHI here.

Sunday, May 10, 2015

Week in Review 19/15

Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week

related to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Friday, May 8, 2015

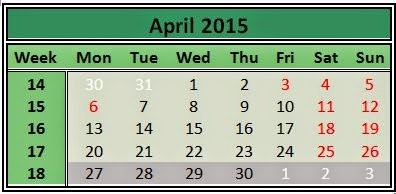

Dividend Income - April 2015

In April 2015 my portfolio dividend income was as

follows:

Annual dividend received from:

Fortum Corporation (FUM1V) - €1560.00 ($1661.56)

TeliaSonera (TLS1V) - €641.60 ($690.36)

NesteOil Corporation (NES1V) - €260.00 ($276.93)

Orion Corporation (ORNBV) - €390.00 ($424.20)

UPM-Kymmene (UPM1V) - €770.00 ($832.83)

Thursday, May 7, 2015

Dividend Increase – TELUS Corporation (TSX: T, NYSE: TU)

Today the Board of Directors of TELUS Corporation announced a quarterly dividend increase of from CA$0.40 to CA$0.42 per share that’s payable July 2, 2015 to holders of record June 10, 2015. This represents a 10.5% increase year-over-year and 5% increase to the last quarter dividend. This was a ninth dividend increase since TELUS announcing their multi-year dividend growth program in May 2011 With current price CA$42.02 (Yesterday's close), this raise brings their dividend yield to 4.0%.

Since I own 50 shares, this will increase my portfolio's projected annual net dividend income by CA$2.98.

That increase rises my YOC to 4.09%.

Click here

to see my portfolio holdings.

You can follow the development of my dividends here.

Wednesday, May 6, 2015

Dividend Increase – PepsiCo, Inc. (PEP)

Yesterday the Board of Directors of PepsiCo Inc. announced a quarterly dividend increase of from $0.655 to $0.7025 per share that’s payable June 30, 2015 to holders of record June 5, 2015. This represents a 7.3% increase to regular quarterly dividends. PepsiCo has paid consecutive quarterly cash dividends since 1965, and 2015 marks the company's 43rd consecutive annual dividend increase. With current price $95.42 (Yesterday's close), this raise brings their dividend yield to 2.94%.

Since I own 100 shares, this will increase my portfolio's projected annual net dividend income by $14.16.

That increase rises my YOC to 3.61%.

Click here

to see my portfolio holdings.

You can follow the development of my dividends here.

Sunday, May 3, 2015

Week in Review 18/15

Welcome and thanks for reading! In this review, I will

gather together important and interesting news and events over the last week related

to my portfolio holdings. In my week review, I put also together some

interesting articles from other websites that caught my attention during the

past week.

Friday, May 1, 2015

Recent Buy - HCP Inc. (HCP)

29th April 2015 I Bought 45 shares of HCP at $41.07 per

share plus commission.

HCP, Inc. is an independent hybrid real estate investment

trust. The fund invests in real estate markets of the United States. It

primarily invests in properties serving the healthcare industry including

sectors of healthcare such as senior housing, life science, medical office,

hospital and skilled nursing. The fund also invests in mezzanine loans and

other debt instruments. It engages in acquisition, development, leasing,

selling and managing of healthcare real estate and provides mortgage and other

financing to healthcare providers. The fund benchmarks the performance of its

portfolio against the S&P 500 Index, Berkshire Hathaway Index, and MSCI

REIT Index. HCP, Inc. was formed in 1985 and is based in Irvine, California

with additional office in Nashville and San Francisco.

Subscribe to:

Comments (Atom)