In this review, I will make a summary of important and

interesting news and events over the last week related to my portfolio

holdings. Also, I will put together some interesting articles from other websites

that caught my attention during the past week.

Sunday, December 29, 2019

Sunday, December 22, 2019

Week in Review 51/19

In this review, I will make a summary of important and

interesting news and events over the last week related to my portfolio

holdings. Also, I will put together some interesting articles from other

websites that caught my attention during the past week.

Friday, December 20, 2019

Recent Buy - Canadian Imperial Bank of Commerce (CM.TO)

On Wednesday, December 18 I bought 11 shares of Canadian

Imperial Bank of Commerce at CA$ 109.56 per share plus commission.

My overall cost basis of this position increases from CA$

105.59 to $ 106.77 per share. I totally hold now 40 shares of CM and my yield

on cost is 5.39%. I purchased my first CM's shares in December 2018, which you

can read here.

Thursday, December 19, 2019

Dividend Increase – Pfizer Inc. (PFE)

Monday the 16th of December the Board of Directors of Pfizer Inc. announced a quarterly dividend increase from $ 0.36 to $ 0.38 per share that’s payable March 6, 2020 to holders of record January 31, 2020. This represents a 5.56% increase to the last quarter dividend.

“The dividend increase is a testament to our commitment

to returning capital to shareholders and reflects our continued confidence in

the business and in our pipeline,” stated Dr. Albert Bourla, Pfizer chief

executive officer. “It also reinforces that our focus on creating meaningful

value for patients benefits all our stakeholders.”

With current price $ 39.01 (Wednesday's open), this raise

brings their dividend yield to 3.90 %.

Tuesday, December 17, 2019

Dividend Increase – AT&T Inc. (T)

Friday the 13th of December the Board of Directors of AT&T Inc. announced a quarterly dividend increase from $ 0.51 to $ 0.52 per share that’s payable February 3, 2020 to holders of record January 10, 2020. This represents a 1.96% increase to the last quarter dividend.

With current price $ 38.26 (Friday's close), this raise

brings their dividend yield to 5.33 %.

Since I own 310 shares of T, this will increase my

portfolio's projected annual net dividend income by $ 9.24.

Monday, December 16, 2019

Dividend Increase – Dominion Energy Inc. (D)

Friday the 13th of December the Board of Directors of Dominion Energy Inc. announced a quarterly dividend increase from $ 0.9175 to $ 0.94 per share that’s payable March 2020. This represents a 2.45% increase to the last quarter dividend.

The expected 2020 dividend increase would mark the 17th

consecutive year in which the annual dividend rate rose from the previous

year's rate and the growth rate approved by the board is consistent with

dividend guidance provided to investors in March 2019.

With current price $ 80.88 (Friday's close), this raise

brings their dividend yield to 4.65 %.

Sunday, December 15, 2019

Week in Review 50/19

In this review, I will make a summary of important and

interesting news and events over the last week related to my portfolio holdings.

Also, I will put together some interesting articles from other websites that

caught my attention during the past week.

Thursday, December 12, 2019

Tuesday, December 10, 2019

Dividend Increase – Enbridge Inc. (TSX:ENB, NYSE:ENB)

Today the Board of Directors of Enbridge Inc. announced a quarterly dividend increase from CA$ 0.738 to CA$ 0.81 per share that’s payable March 1, 2020 to holders of record February 14, 2020. This represents a 9.76% increase to the last quarter dividend.

With current price CA$ 51.50 (today's open), this raise brings their dividend yield to 6.29 %.

Since I own 150 shares of ENB, this will increase my

portfolio's projected annual net dividend income by CA$ 32.18.

This increase raises my YOC to 6.40%.

Sunday, December 8, 2019

Week in Review 49/19

In this review, I will make a summary of important and

interesting news and events over the last week related to my portfolio

holdings. Also, I will put together some interesting articles from other websites

that caught my attention during the past week.

Sunday, December 1, 2019

Week in Review 48/19

In this review, I will make a summary of important and

interesting news and events over the last week related to my portfolio

holdings. Also, I will put together some interesting articles from other

websites that caught my attention during the past week.

Sunday, November 24, 2019

Week in Review 47/19

In this review, I will make a summary of important and

interesting news and events over the last week related to my portfolio

holdings. Also, I will put together some interesting articles from other websites

that caught my attention during the past week.

Sunday, November 17, 2019

Week in Review 46/19

Welcome and thanks for reading!

In this review, I will make a summary of important and

interesting news and events over the last week related to my portfolio

holdings. Also, I will put together some interesting articles from other

websites that caught my attention during the past week.

Tuesday, November 12, 2019

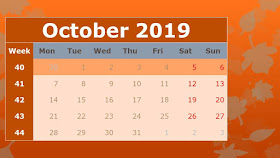

Dividend Income - October 2019

November is already almost halfway through and it is time

to report my dividend income. In October 2019 my portfolio dividend income was

as follows:

Sunday, November 10, 2019

Week in Review 45/19

In this review, I will make a summary of important and interesting

news and events over the last week related to my portfolio holdings. Also, I

will put together some interesting articles from other websites that caught my

attention during the past week.

Thursday, November 7, 2019

Dividend Increase – TELUS Corporation (TSX: T, NYSE: TU)

Today the Board of Directors of TELUS Corporation announced a quarterly dividend increase of from CA$ 0.5625 to CA$ 0.5825 per share that’s payable January 2, 2020 to holders of record December 11, 2019. This represents a 6.88% increase year-over-year and 3.56% increase to the last quarter dividend. This was an eighteenth dividend increase since TELUS announcing their multi-year dividend growth program in May 2011.

With current price CA$ 47.85 (today's open), this raise

brings their dividend yield to 4.87 %.

Since I own 180 shares of TELUS, this will increase my

portfolio's projected annual net dividend income by CA$ 10.73.

This increase raises my YOC to 5.33%.

Sunday, November 3, 2019

Week in Review 44/19

In this review, I will make a summary of important and

interesting news and events over the last week related to my portfolio

holdings. Also, I will put together some interesting articles from other websites

that caught my attention during the past week.

Friday, November 1, 2019

Dividend Increase – AbbVie Inc. (ABBV)

Today the Board of Directors of AbbVie Inc. announced a

quarterly dividend increase of from $ 1.07 to $ 1.18 per share that’s payable February

14, 2020 to holders of record January 15, 2020. This represents a 10.18%

increase to regular quarterly dividends. With current price $ 80.03 (today's open),

this raise brings their dividend yield to 5.90%.

Since I own 80 shares of ABBV, this will increase my

portfolio's projected annual net dividend income by $ 26.22.

This increase raises my YOC to 6.88%.

Sunday, October 27, 2019

Week in Review 43/19

In this review, I will make a summary of important and

interesting news and events over the last week related to my portfolio

holdings. Also, I will put together some interesting articles from other

websites that caught my attention during the past week.

Friday, October 25, 2019

Dividend Increase – VF Corporation (VFC)

Today the Board of Directors of VF Corporation announced a quarterly dividend increase of from $ 0.43 to $ 0.48 per share that’s payable December 20, 2019 to holders of record December 10, 2019. This represents an 11.63% increase to regular quarterly dividends. With current price $ 90.82 (yesterday's close), this raise brings their dividend yield to 2.11%.

Since I own 85 shares of VFC, this will increase my

portfolio's projected annual net dividend income by $ 12.67.

This increase raises my YOC to 3.61%.

Sunday, October 20, 2019

Week in Review 42/19

In this review, I will make a summary of important and interesting

news and events over the last week related to my portfolio holdings. Also, I

will put together some interesting articles from other websites that caught my

attention during the past week.

Tuesday, October 15, 2019

Dividend Increase – Omega Healthcare Investors, Inc. (OHI)

Yesterday, October 14 the Board of Directors of Omega Healthcare Investors, Inc. announced a quarterly dividend increase of from $ 0.66 to $ 0.67 per share that’s payable November 15, 2019 to holders of record October 31, 2019. This represents a 1.52% increase to regular quarterly dividends. With current price $ 43.02 (yesterday's clse), this raise brings their dividend yield to 6.23%.

Since I own 185 shares of OHI, this will increase my

portfolio's projected annual net dividend income by $ 5.51.

Sunday, October 13, 2019

Week in Review 41/19

In this review, I will make a summary of important and

interesting news and events over the last week related to my portfolio holdings.

Also, I will put together some interesting articles from other websites that

caught my attention during the past week.

Thursday, October 10, 2019

Dividend Income - September 2019

Time seems to be going really fast these days, another

month is gone, winter is coming, soon Santa is knocking at the door and it's

time to celebrate the New Year! Anyway, it's time again to report my dividend

income. In September 2019 my portfolio dividend income was as follows:

Tuesday, October 8, 2019

Dividend Increase – ConocoPhillips (COP)

Yesterday, October 7 the Board of Directors of ConocoPhillips announced a quarterly dividend increase of from $ 0.305 to $ 0.42 per share that’s payable December 2, 2019 to holders of record October 17, 2019. The company also announced that it expects to repurchase $3 billion of its shares in 2020. This represents a 37.7% increase to regular quarterly dividends. With current price $ 53.90 (today's open), this raise brings their dividend yield to 3.12%.

“This increase in our ordinary dividend reflects the

significant transformation our company has undergone over the past few years,”

said Ryan Lance, chairman and chief executive officer. “Since announcing our

returns-focused value proposition in 2016, we have improved our underlying

performance drivers and lowered our sustaining price for the business. Given

these enhancements, we are confident we can fund a higher, growing cash

dividend, while maintaining a substantial, consistent buyback program. Since 2016

we have returned about 45 percent of cash from operations to shareholders and

we remain committed to delivering peer-leading return of capital annually.”

Since I own 30 shares of COP, this will increase my

portfolio's projected annual net dividend income by $ 10.28.

Sunday, October 6, 2019

Week in Review 40/19

In this review, I will make a summary of important and

interesting news and events over the last week related to my portfolio

holdings. Also, I will put together some interesting articles from other

websites that caught my attention during the past week.

Monday, September 30, 2019

Dividend Increase – Emera Inc. (EMA.TO)

Friday, September 27 the Board of Directors of Emera Inc. announced a quarterly dividend increase of from CA$ 0.5875 to CA$ 0.6125 per share and extended its dividend growth rate target of four to five per cent to 2022. New quarterly dividend is payable November 15, 2019 to holders of record November 1, 2019. This represents a 4.26% increase to regular quarterly dividends. With current price CA$ 58.44 (Friday's close), this raise brings their dividend yield to 4.19%.

“This increase is consistent with our dividend growth

rate target of four to five per cent and reflects our confidence in the

continuing growth of our business,” said Scott Balfour, President and CEO of

Emera Inc. “Our significant rate base investments are expected to drive

long-term cash flow and EPS growth in support of the dividend over the guidance

period.”

Since I own 130 shares of EMA, this will increase my

portfolio's projected annual net dividend income by CA$ 9.69.

Sunday, September 29, 2019

Week in Review 39/19

In this review, I will make a summary of important and

interesting news and events over the last week related to my portfolio

holdings. Also, I will put together some interesting articles from other

websites that caught my attention during the past week.

Sunday, September 22, 2019

Week in Review 38/19

In this review, I will make a summary of important and

interesting news and events over the last week related to my portfolio

holdings. Also, I will put together some interesting articles from other

websites that caught my attention during the past week.

Friday, September 20, 2019

Dividend Increase – McDonald's Corporation (MCD)

Yesterday, September 19th the Board of Directors of McDonald's Corporation announced a quarterly dividend increase of from $ 1.16 to $ 1.25 per share that’s payable December 16, 2019 to holders of record December 2, 2019. This represents a 7.76% increase to regular quarterly dividends. With current price $ 210.52 (yesterday's close), this raise brings their dividend yield to 2.38%.

McDonald's has raised its dividend for 43 consecutive

years since paying its first dividend in 1976. The new quarterly dividend of

$1.25 per share is equivalent to $5.00 annually. In addition, 2019 represents

the final year of the Company's three-year cash return to shareholders target

of about $25 billion. Through August, the Company returned a cumulative $21

billion and is on track to complete the remaining amount by the end of the

year.

Sunday, September 15, 2019

Week in Review 37/19

In this review, I will make a summary of important and

interesting news and events over the last week related to my portfolio

holdings. Also, I will put together some interesting articles from other

websites that caught my attention during the past week.

Friday, September 13, 2019

Dividend Income - August 2019

Summer is over, autumn has begun and it is time to report my dividend income. In August 2019 my portfolio dividend income was as follows:

Extraordinary dividends

received from:

|

|||||

€

|

$

|

||||

Tele2 B (TEL2-B)

|

125.28

|

137.97

|

|||

Quarterly dividends received

from:

|

|||||

€

|

$

|

€

|

$

|

||

AT&T Inc. (T)

|

141.67

|

158.10

|

Williams-Sonoma, Inc.

(WSM)

|

19.65

|

21.60

|

Kinder Morgan, Inc.

(KMI)

|

45.07

|

50.00

|

Eaton Corporation plc

(ETN)

|

19.20

|

21.30

|

ONEOK, Inc. (OKE)

|

39.95

|

44.50

|

Lazard Ltd (LAZ)

|

42.42

|

47.00

|

General Mills, Inc.

(GIS)

|

26.52

|

29.40

|

Omega Healthcare

Investors, Inc. (OHI)

|

109.91

|

122.10

|

AbbVie Inc. (ABBV)

|

67.42

|

74.90

|

Tanger Factory Outlet

Centers, Inc. (SKT)

|

47.44

|

53.25

|

CVS Health Corporation

(CVS)

|

51.36

|

57.50

|

Royal Bank of Canada

(RY.TO)

|

83.19

|

92.36

|

WestRock Company (WRK)

|

28.74

|

31.85

|

Emera Incorporated

(EMA.TO)

|

51.60

|

57.54

|

Monthly dividends received

from:

|

|||||

€

|

$

|

||||

Main Street Capital

Corporation (MAIN)

|

42.42

|

26.65

|

|||

LTC Properties Inc.

(LTC)

|

16.86

|

19.00

|

|||

Realty Income Corp (O)

|

17.31

|

19.25

|

|||

Inter Pipeline Ltd.

(IPL.TO)

|

31.47

|

34.89

|

|||

Global X SuperDividend

ETF (SDIV)

|

66.88

|

75.12

|

|||

P2P Loans

|

70.05

|

77.13

|

|||

TOTAL

|

€1,126.31

|

$1,251.41

|

|||